Ready to Embark on an Exciting Journey with WIN?

Take the first step toward personal and financial freedom by filling out the interest form. One of our franchise advocates will be in touch with you soon!

In an era marked by rapid technological advancements and the desire for on-demand services, the home services industry in the U.S. has evolved as a linchpin of comfort and convenience. From the professionals who ensure our homes remain clean, healthy, and safe to those who help bring our dream interiors to life, the industry is as diverse as it is essential.

Encompassing essential services ranging from home inspection, plumbing, electrical maintenance, landscaping, cleaning, and HVAC (Heating, Ventilation, and Air Conditioning) to personal services like elder care and tutoring, the home services industry is an expansive network that touches nearly every facet of our day-to-day lives.

While the demand for these services remains consistent, consumer behavior, expectations, and industry dynamics are everchanging. As such, diving deep into the statistics of this industry is not just a pursuit of numbers, but an exploration into the heart of American households and the professionals who make them feel like homes.

Understanding the home services industry through a lens of numbers offers a comprehensive view of its scale, dynamism, and significance in the American economy. Here are some key insights and statistics:

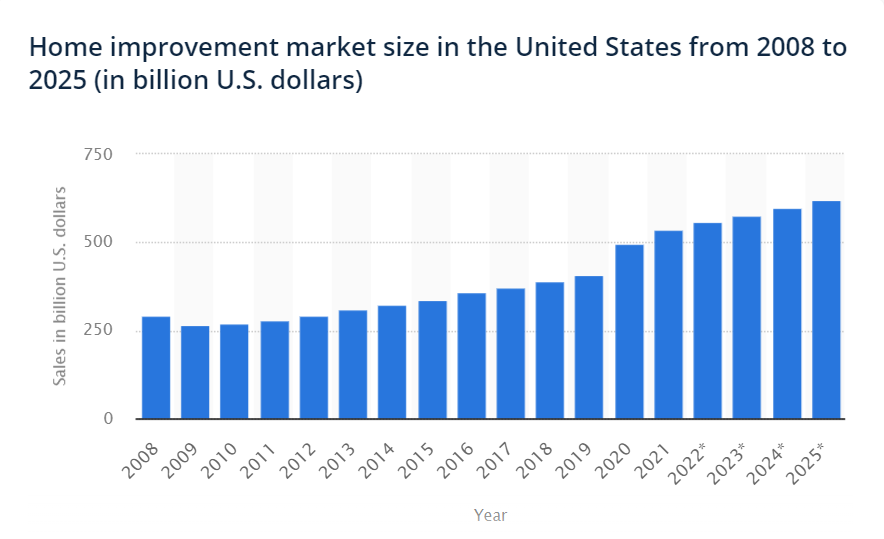

As of 2022, the U.S. home services industry was estimated to be worth over $650 billion. This was a growth from approximately $500 billion in 2017, reflecting a clear upward trend.

The aggregated annual revenue of businesses in this sector was around $600 billion in 2022. Professions like HVAC and plumbing, given their essential nature, often commanded a significant share of this revenue.

In 2018, the U.S. home services market was valued at $105.55 billion, and it is anticipated to reach $1219.07 billion by 2026, with a compounded annual growth rate (CAGR) of 35.81% from 2019 to 2026. This steady growth underscored both the consistent demand for services and the industry’s resilience.

States like California, Texas, and New York typically led in terms of revenue contribution due to their urban density and corresponding service demand. In terms of growth rates, the Sun Belt region, including states like Florida and Arizona, experienced heightened demand, partly due to demographic shifts.

Around 75% of consumers were leveraging online platforms to book or research home services. The utilization of online bookings for home services surged by 52% between 2019 and 2022, emphasizing the industry’s pivot toward digital engagement.

The industry was a significant source of employment, providing jobs to over 5 million Americans. This not only showcased its economic importance but also highlighted its role in the nation’s service-driven model.

The robust growth and resilience of the home services market isn’t merely coincidental; it’s driven by a combination of socio-economic, demographic, and infrastructural factors.

The American dream, for many, is synonymous with homeownership. As of 2022, the homeownership rate in the U.S. had surged to approximately 65.9%, up from 63.7% in 2016. This increase in homeownership directly correlates with the demand for home services. New homeowners, in particular, often require a plethora of services, from plumbing to landscaping, to make their new house truly feel like a home.

A significant portion of American homes, especially those built during the mid-20th century, are now grappling with the realities of aging infrastructure. In 2022, it was estimated that nearly 40% of homes in the U.S. were over 50 years old. Aging homes require more frequent repairs and maintenance, resulting in an amplified demand for services related to plumbing, electrical work, roofing, and structural repairs.

The modern consumer, with increasing disposable income and evolving lifestyle aspirations, demands a home that is not just functional, but also aesthetically appealing and technologically integrated. The home improvement industry is on the rise, with a noticeable surge in the number of remodeling businesses in the U.S. These businesses have been growing at an average annual rate of 3.8% from 2017 to 2022, clearly demonstrating the industry’s rapid expansion reaching a staggering $577 billion in 2023. This rise underscores the consumer’s willingness to invest in services that enhance their living spaces.

The integration of technology into home services cannot be overstated. Platforms that connect homeowners with service providers have become the norm. Nearly 75% of homeowners had used an online platform or app to book a home service, illustrating the symbiotic relationship between technology and industry growth.

In essence, the home services market’s dynamism in the U.S. can be attributed to a blend of long-standing cultural aspirations, infrastructural realities, consumer behaviors, and technological advancements. Each of these factors, either in isolation or conjunction, has been instrumental in shaping the trajectory of the industry.